Disclaimer: I am not a financial advisor and this page exists to aid you in your research, but not make or suggest decisions for you. Further research is recommended for you to draw a conclusion of your own. Additionally some links contained on this page may be affiliate links in which Dynastus will receive a portion of sales at no additional expense to you.

Precious metals have taken their place throughout history as a store of value. Prior to a lot of countries shifting to a debt based economy, dollars were able to be traded for gold at any local bank. Times certainly have changed. If you came for a quick answer to the question to the tune of “Are precious metals a good investment?” The answer is no, and will always be no…but also kind of yes.

As is the way here on Dynastus, I’ll be diving into the details, and why you should maybe still look at buying a little bit of metal.

The History of Precious Metals

There was a point in history where you could redeem treasury notes(paper cash) for gold. This was referred to as the gold standard. Nowadays, instead of dollars being backed by precious metals, economies are based on debt and leverage as opposed to unproductive metal (which is not a good thing, but that’s a subject for another article). There are still instances where metals can be exchanged for a fixed value, however.

For example, Silver Canadian Maples can be exchanged for 5 Canadian dollars, backed by the Canadian government. That’s pretty cool until you see that the cost of a Canadian maple(at the time of writing) is over 3 times that.

Before the relatively modern era, Coins were often made of gold or silver. A lot of older US currency contains a certain % of silver actually(affectionately called junk silver). Quantities of junk silver can often be purchased on sites like eBay, or from estate sales etc. More on this later.

Earlier still, coins made of gold, silver, and copper were used among merchants, a lot of old coins made the rounds between cities and towns on the backs of horses and camels and on ships.

One thing that really interested me, even as a boy, is how every savvy merchant would shave a little metal of each coin as it passed through their hands, slowly eroding the coin down from a full-size coin to a sliver of its former self. The value was expected to be retained(like modern fiat currencies) but merchants would often not accept a coin that was too small. Therein lie some of the difficulty with using PMs as a common means of trade.

Precious Metals Aren’t Really An Investment

A lot of people say that gold and silver are a good store of value. I really beg to differ. Warren Buffet famously said that gold is the only investment where you pay over and over, you pay to dig it up out of the ground, pay to turn it into bars and coins, then pay to put it back under the ground again in storage vaults.

One key tenet of a good investment is that its creates value or produces additional resources. Once you buy gold, silver, copper or anything, your money is tied up. This metal isn’t throwing off any appreciable cash flow. Unless you keep it in your house(I advise against this unless you have adequate safety measures) you’re effectively paying to protect it. Therefore, it’s an item that costs you on an ongoing basis. Not to mention the fact that you can miss out on other more lucrative opportunities by having your money tied up in it.

That’s a decent chunk of metal/money – or several shares in a local utility company or a few mortgage payments. Serial number blanks because I’m paranoid AF.

Buying and selling precious metals isn’t really investing, it’s speculating, in that you hope there’s a “Greater Fool” that will pay more than you did for a lump of cold, dead metal. If you are going to speculate, there are several ways you can do this, but I’ll get more into the ways you can own PMs later.

PMs Historic Under Performance

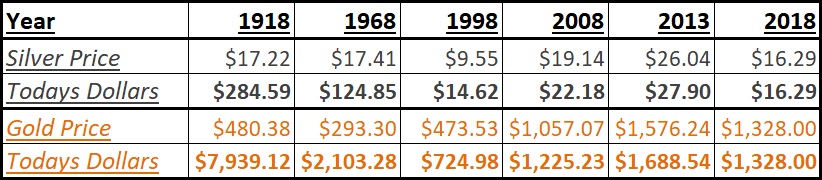

The reality is precious metals haven’t really climbed significantly in value for the past century. They’ve actually fallen a fair bit. If you purchased gold 100 years ago it would have set you back $480 an oz, in today’s dollars that would have equated to $7939.12. If you held that gold, today you’d be able to sell it for #1300-1400 an oz. That’s terrible. 20 years ago it would have cost you 473.53 an oz. In today’s dollars that would have been $724.98, should you sell, you’d near have doubled your money. So in answer to the question “Are precious metals a good Investment?” in this regard the answer is a strong “no.”

So you can see why blindly holding can be a little silly. It gets worse. Silver 100 years ago was 17.22 an oz, around what is today ($17). In relative dollars, it would have been $284.59 an oz, a net real loss of about $267/oz. The reason it is diminishing in value(other than more stockpiling) is the relative ease to actually pull it up. Automation efficiencies have made silver mining much easier in recent history.

You tell me – are precious metals a good investment?

The 90s saw the lowest in PM prices, this is most likely because so much money was being diverted into the tech bubble and other investments were largely being ignored. It actually made for a pretty good buy I guess, but you would have made more money in index funds than in PMs.

The Whys of Buying PMs

Despite the fact that Precious Metals aren’t really an investment, there are still arguments as to why you should still get a bit of precious metal. For now, we’ll cover why you should still make PMs a part of your portfolio, how to do so and how to balance it.

Finite resource

Just like land, they aren’t really ‘making’ any more metals. Though they are always mining more. While the argument can be made that you can synthesize metals, it’s expensive and impractical. Therefore these are a diminishing resource. The key thing here is that you need to look for a metal that’s being consumed, or is set to be consumed into the future.

I first held copper many, many moons ago as it was all that was available to me, for free mind you. I saved every little scrap of wire and cable I could and added it to a large bin in my parents shed. It started small, but over time(months) these bits of copper added up to be several kilos. As I added them, I stripped off the plastic sheathing, which added value to the copper. Once I had a sizable amount I watched the copper prices and ultimately sold it all for a few hundred dollars when there was a jump in price.

Practical Applications

Now copper obviously has a lot of practical uses, but Silver is a higher value metal that also has a lot of uses. See, copper takes up a heck of a lot of space, and its value per oz or kilogram is relatively low compared to something like silver or gold. Same goes for platinum. I won’t get into these uses just yet, but know that the metal having a practical use plays a large role in the selection of metals.

Liquidity

Some metals are easy to liquidate, others, not so much. Copper can be taken to a local scrap dealer and is easy to offload. You can ring around, find the best price(taking into note travel costs), then drop it off and walk away with some cold, hard fiat.

Silver is a little different, but still fairly liquid. If you know what you’re doing, then you can find a reputable buyer, sell on an auction site or sell directly to other silver bugs. A lot of buyers will want to drill into the bar or round assure it’s authenticity. Don’t let this happen. I personally look for silver with assay certificates to prevent this from happening, at least for larger quantities.

The ability to sell your metal of choice is definitely something to consider when you ask yourself: “Are precious metals a good investment?”. Copper can be sold at any scrap yard, silver is easily sold (usually with a nice premium) on auction sites.

Even with at, its harder to draw money out of PMs than it is from a bank, so they don’t really make a good emergency fund. And before you rush to the comments to say they’re a great apocalypse currency, you can’t eat or wipe your butt with a silver coin. They are not apocalypse currency (nor will bottle caps be, though the concept is pretty cool ala Fallout).

Space

As you amass a certain amount of metal, you’ll find it takes up a lot of space. The use of copper certainly isn’t going anywhere, but it takes up a lot of space relative to other PMs. Copper is certainly easier to come by, especially in a trade like plumbing, or electrical, but you’d be better off accumulating, selling, then swapping to another PM like Platinum or Silver.

The density and portability of your metal of choice is definitely something to consider when you ask yourself: “Are precious metals a good investment?”. I like gold jewelry for the sake you can wear it as a something you can sell or barter with if the time ever came for that.

Precious metals vs other potential physical speculative plays are rather compact relative to their values. You could build up a significant number of 10oz bars and store them in a small vault, vs holding a classic car, or an art piece etc.

Age Tested

People love shiny stuff. Why? I have no clue. I certainly see the allure, though I can’t justify it. Silver is just pretty dang cool. But this isn’t what I’m getting at. The lure of accumulating precious metals is one that’s stood the test of time, and I get the feeling it isn’t going to disappear.

Personally, I collect silver for the fact that I want to build generational wealth. If there was a black swan event, and silver prices were to spike, I’d look at selling, no doubt. Not being afraid to sell when the market overvalues something is a key attribute of a value investor.

Short of this black swan event though, I plan on the silver I buy and preserve now being passed down to my great-grandchildren. Call this a transfer of Financial Capital, in a sense. And maybe one day this silver I’ve bought and held will have its value realized and be used to further my family one or two hundred years down the track.

That’s one reason why it’s so important to build a strong wealth culture in your family. What you set up now will separate the wheat from the chaff in generations to come, precious metals can be a great fit for a dynastic portfolio.

The big guns are stacking

Some of the world’s billionaires are accumulating precious metals. In particular silver. We’re talking JP Morgan amassing a vast amount of silver. Even Warren buffet held 37% of the worlds silver at one point in time. He has since sold, but even that move was considered controversial.

So Why did I choose silver?

For collecting metals, I had a few choices, gold, silver, platinum and copper. I guess I started with copper, but just for the sake of the trade I was in and getting it for free, working with what I had. When I had to choose what to buy I picked silver.

I chose silver as it is fairly popular, but not prohibitively so. You can build a nice stack that’s easy to sell off a portion of relatively easily. Silver does tarnish, but only if improperly cared for. They also come in oz sized coin form – often referred to as ’rounds’, which I picked a few up of as well. Having a few sizes allow you to have more control over the portion you sell. Though in hindsight, I wouldn’t have bought so many maples as I really don’t believe they’ll grow in value as a coin over time.

Countless Uses

Silver has many practical uses. Its used in jewelry, solder, dental fillings, and tableware. It’s also used in photography(silver salts), mirrors(best reflector of light), telescopes and printed circuits(silver paint).

All of the above and more. It’s actually antibacterial and is used in medical applications and in clothing to prevent bacterial build up. Gloves have silver threads woven in to use a touchscreen with. The list just keeps going.

In our ever-changing world, silver seems to be a bigger and bigger requirement. There’s always the risk that a synthetic material will take the place of silver, but they said that about wood 20 years ago. As our hospitals become more crowded, and we use touchscreens more, and our society needs more sterile environments, as we send probes and telescopes into space, and our dependence on electronics grows, so too will the demand for silver. At least in my opinion.

Worst case, far into the future, everybody will surely desire to wear jewelry made from rock that the ancient folks thought looks pretty, so there’s that too. Or maybe that’s a stretch. I put a very small portion of my wealth into silver, so even if it all flops and Merlin the Wizard comes from the future to conjure up silver from finger dust, it’s no big deal.

So consider all this when you ask yourself the question: “are precious metals a good investment?”

A Word on Chinese Pandas

Chinese Pandas are a form of bullion made in a limited run in China. Panda’s, in my opinion, are a great buy if you can get a few each year. People love to purchase full sets of things(look at Pokemon for example),. The same goes for coins. Every year the panda design changes. So if you buy a few of each design every year, you can build up a catalog, which in the future you can sell off for a real gain, disproportionate to the silver spot price gains – pure collector value.

For a beginner, pandas are a fairly safe bet. You don’t want to go back further than a year when building your collection. Think logically and only buy for their future value. you aren’t collecting these, you’re using them to build wealth. I imagine having a 50 year set further down the line will be worth a sizable amount.

So how much should you get?

Consider all of the above in your desire to discover the answer to: are precious metals a good investment?”.

Honestly, I wouldn’t advise putting more than 1% of your net-worth, outside of your personal home value, into any Precious metal. It really depends on your personal tastes, views, and research.

I say such a small percentage as you’re really putting your faith in somebody valuing it higher than you in the future, and any kind of pure speculation play is never really a great move. You’re basically putting your money in the hands of others, and when was the last time you trusted somebody else with your money?

You can make a lot of money speculating on metals, sure, but you’d be better be well clued up and taking advantage of leverage, and probably using some sort of trading platform, rather than buying and selling physical metal.

Getting Started

There are a few ways you can get started, and can actually make quite a hobby of PM collecting. and define your own answer to the question: “Are precious metals a good investment?”

Metal Detecting

If you’re time abundant and are looking for an interesting hobby, metal detecting can be a pretty cool way to start a metal collection. Amongst all the bottle caps you’re likely to find, occasionally you’ll manage to find a neat coin or ring or even a relic.

Panning

I was hesitant to write this one, but you can actually still pan for gold and other metals. Panning involves sifting using a specially designed pan through sediment for flakes or tiny nuggets of gold. I’m not really qualified to talk about this honestly, panning is a little lost on me.

I have seen people find gold flakes in some sand and gravel from the hardware store. Doubt you’d be able to pay for the bag with the gold but if you need the gravel anyway and have nothing but time, there you go.

Oi! You got a loicence for that gold being washed out to sea there guv-nah? Note that in some more restrictive countries (like New Zealand) any and all gold found belongs to the state. Are precious metals a good investment? Not if it may result in some fines or time in the clinker.

Local Dealers

This isn’t really a thing in my country(we’re meant to be classed as ‘first world’ though), but I hear that there are local PM dealers you can visit in other parts of the world that deal with the public. Personally, I think you’d be better off shopping around online in the modern age, however.

Scrapping

If you have the taste for a bit of chemistry, you can look to scrapping electronics. Through a chemical process, you can actually chemically remove the gold from plating, then through another process reconstitute it back into gold. The economy of this is dubious, but it is profitable if done correctly

If you’ve access to it, you can also strip copper cabling(I do this) and piping, or find other metals in various devices.

The scrapped copper I stripped over the past several nights. Though collected over a few weeks.

Junk Silver

Oh, how I wish this was economical in my country. Early coins in the United States contained a rather high percentage of silver. With enough effort, you can actually secure these below their melt value and consequently turn a profit. Or you can hold them to later sell at a profit. Whether you melt them down yourself or not is entirely up to you. Though without sufficient volume, I feel that you’d be better off selling them as is. This (along with nabbing jewelry under spot price) are the only things that would change my opinion on the question “Are precious metals a good investment?”.

Pre-1982 Copper Pennies

In America, pennies used to be made of 95% copper. This means that they actually outweigh their fiat denomination in scrap value. If you can find a good source of these pennies, they can be a reliable way to spin your money up.

Copper takes up a hell of a lot of room. I remember seeing a YouTube video by a guy who did this and his house was a little…goat-trail-ey. No shame in profit-taking – space has value too.

Online

I personally purchase online through a reputable Canadian dealer, SilverGoldBull.com. Even though I live an ocean away, this still works out more economical than local dealers. I’ve bought locally to find the poor presentation, milk spots, and scratches. (Everybody is bad at their jobs in my country, even our prime minister). You can also look on places like eBay or Amazon, though you want to be careful of getting scammed. I think it’s worth the extra measure of protection, even if it costs a little more.

On Trading Platforms

If you aren’t worried about actually touching and holding your PMs, you can use online trading platforms to buy positions in PMs. These are really better for people looking to rapidly trade PMs as a means of generating income. I’ve done this and broken even and count myself lucky. It involves a lot of time, knowledge and skill, and you’re basically trading on small market inefficiencies. Though as time goes on, I can’t help but feel efficient market hypothesis(especially weak form) is becoming more and more of a theory.

ETFs

Weird one here, but you can actually buy PMs through ETFs(exchange-traded funds). These funds are set up to either physically hold one or a portfolio of metals, or some security related to the metals, such as futures. Here’s a list of Gold ETFs you can check out if that’s your speed. Or Silver ETFs here.

Uses of Different Precious Metals

Different metals have different uses. When picking which metal is the right fit for you, you want to be looking for the fastest growing use(on top of liquidity). The narrower the line between supply and demand, the better. The difficulty in production is also a key tenet. If the refining processes difficulty is on a raw chemical level, then that’s actually great – unless a breakthrough is made that makes it super easy to refine. Then the value would surely drop.

An example is that silver is easier than ever to get out of the ground, and it’s production is, therefore, cheaper, and the spot prices reflect that.

Gold

Uses: Jewelry, locking in vaults, some electronics(but the price is typically prohibitive)

More on gold to come in a separate article. For now, let me put it like this. At the end of 2017, 190,040 tonnes of gold have been mined and are in storage, with about 54,000 yet to be mined at present(in existing, discovered veins). Nearly all of this is still in circulation. about 2500-3000 more tonnes are added to stock piles annually, none of which really gets used on any significant scale. Not to mention that gold is highly desired by thieves – adding to the fact you should pay to store any significant amounts and factoring the ongoing expense into the question “Are precious metals a good investment?”

Silver

Uses(abridged): Jewelry, Medical Instruments and applications, solder, electronics, batteries(think electric cars here), engines(cars again!), mirrors, antibacterial weavings, washing detergents, fillings, water purification, plastics, weather control(no conspiracy here!), solar power….ok that’s enough for now. A quick google search will show you loads and loads more.

Historically, about 1,500,000 million tonnes of silver has been mined up and brought above ground. But here’s the thing, unlike gold, only about 4% of that is still in circulation today. Due to its hundred(if not thousands) of uses, silver is getting used up, and thrown in landfills. The use of silver isn’t really dropping either.

I’ll write more on this in a separate article specifically on why silver is my PM of choice.

Platinum

Uses: Jewelry, Catalytic converters(trucks, cars, buses), Catalyst in chemical industry, hard disks, optical fibers, LCDs, turbine blades, pacemakers, fillings, spark plugs, chemotherapy, fertilizer(we need this to feed the growing population), vehicles(think electric cars), medical implants.

The annual demand is around 230 tonnes per year, and mining output is less than 1% of silver(less than 250 tonnes). The demand is growing, and mining is difficult, so higher prices can be expected as time goes on. I personally think platinum makes for a good PM move, but it is prohibitively expensive and fairly illiquid.

How to Hold Metals

So what’s the best way to hold metals? In your hand.

But seriously, don’t keep them at home. You might have a fairly safe and secret place(like a large property with a secret underground undetectable hiding place) or can keep a really good secret. You still shouldn’t hold any PMs on your property. And this factors into the question: “Are precious metals a good investment?”. They will cost you money to hold, if you are even remotely paranoid.

Keep precious metals in a storage locker or in a vault specifically designed to store PMs. The downside to this is that your putting a bit of control in the hands of others, but if you have a sizeable amount, his is the safest bet If you just like to look at it, you can keep a bit at your place, but you really shouldn’t keep any sizeable amount for long.

I wrote this post just after my latest order came in, all pictures taken for the purposes of this post are about to go into a vault I rent for a monthly fee. I actually was inspired to write this as this order just came in and I thought it would be a cool thing to write about. I like to go over everything, check the assay certificates and put it in the vault personally. Peace of mind, I suppose you’d call it. No pictures of the vault are allowed, so can’t show you that. It isn’t really anything special though, so here’s a picture of a cool vault instead.

Conclusion

So all up, are precious metals a good investment? No. No, they aren’t. But that doesn’t mean you can’t speculate. You can consider it perhaps building some generational wealth through the long-term holding of metals that actually have some use.

It’s important to look for practicality when it comes to you metal selection and makes informed decisions. Supply and demand will play a stronger role than ever in metals moving forward. This is doubly true now that technology has progressed to a point when mining is more efficient than ever. Metals really aren’t a hedge against inflation as we saw historically. Inflation isn’t linear so practicality plays a major role in their value, rather than pure speculation based on the greater fool approach.

Our reliance on these resources(except gold) is growing at a rapid pace and they will play a larger role in our growing society as our population grows. While they don’t throw off any cash flow, they can be bought and sold on peaks and troughs to help accumulate wealth. Your family can also hold Precious metals long term as part of a dynastic portfolio of family assets in the hope of diminishing supply much longer term.

Whatever your approach, precious metals can be a good part of a portfolio, though shouldn’t be considered a store of wealth.

What do you think? Do you hold any ingots or bullion, looking to get in or get out? Let me know in the comments below.

Thanks for reading. Yours,