Everybody talks about emergency savings. And everybody should probably have them. But what about a fund that acts as a pseudo-income that also grows on its own to match inflation? An ’emergency ladder fund’ of sorts you can use to climb out of dangers way.

This is an emergency fund structure, affectionately called ‘The Emergency Ladder Fund’. A different approach to your emergency savings that will act as a monthly placeholder income in dire times while you pull your life back together. An emergency fund is an important component of your family financial capital that shouldn’t be ignored.

If you don’t know what emergency savings are, worry not. I have a full post on them, and how to build them right here.

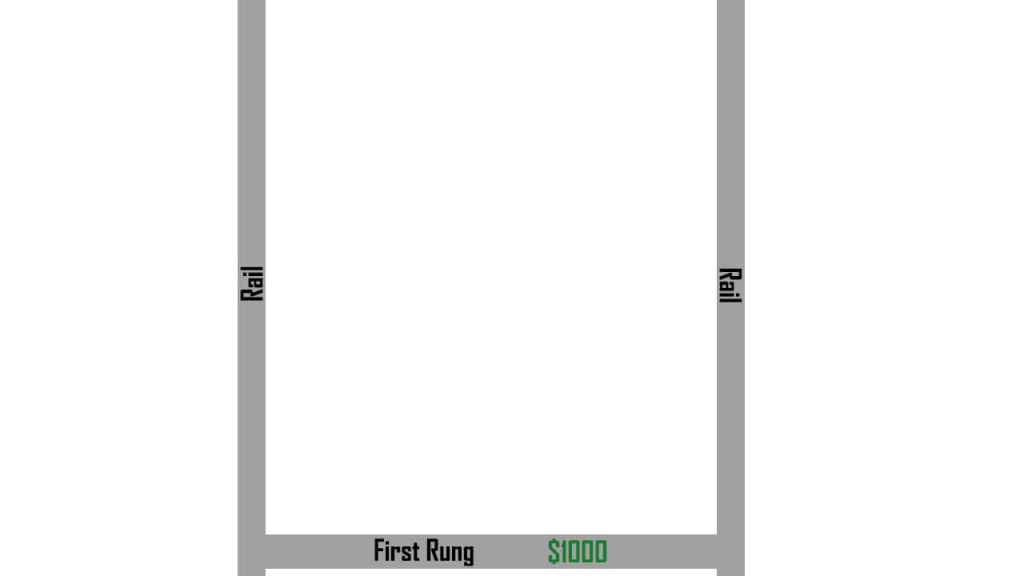

The First Rung

So to begin building your emergency ladder fund, let’s first look at how we want it to function. A ladder is made of a couple of key components, the rails..and the rungs. The rails are the system the thing that holds the rungs in place, while said rungs are the fund themselves.

This is a ladder, if you’re unfamiliar.

The beauty of the emergency ladder fund is once you’ve built it, it’s fairly self-sustaining. It should reasonably keep up with CGI inflation, and with any luck maybe even grow a little bit as well. Plus you can always make additional, monthly contributions to have it protect you even more in the future.

We’ll use a simplified example to make it easy to follow along. So say you wanted money enough to last a whole year and need $12,000 to make that happen.

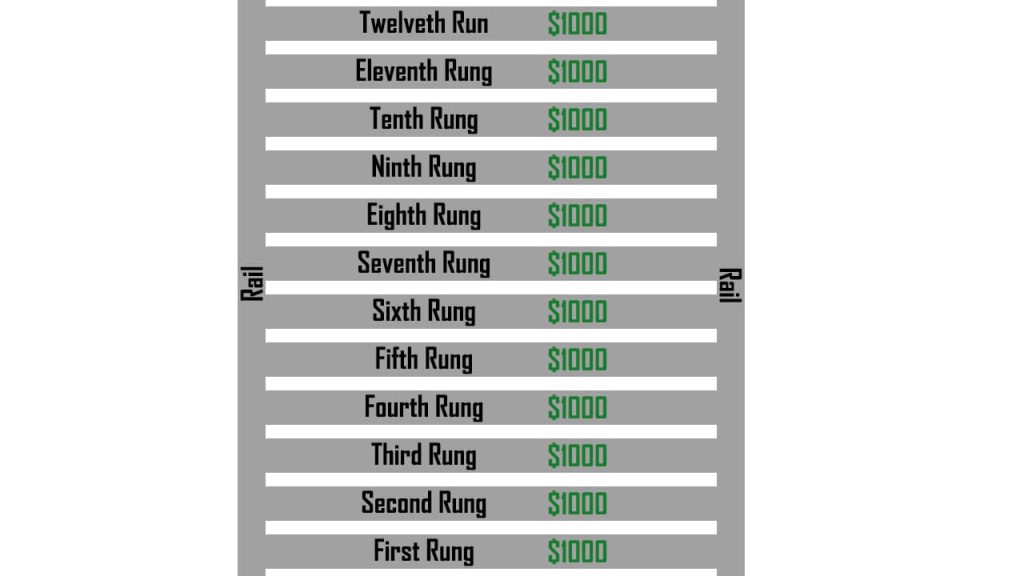

Instead of having a big pool of funds in a savings account, you need to break it into smaller amounts. Bite-sized chunks sized to the amount you need each month. In this example, $1000. These smaller emergency funds will function as the rungs of your emergency ladder fund.

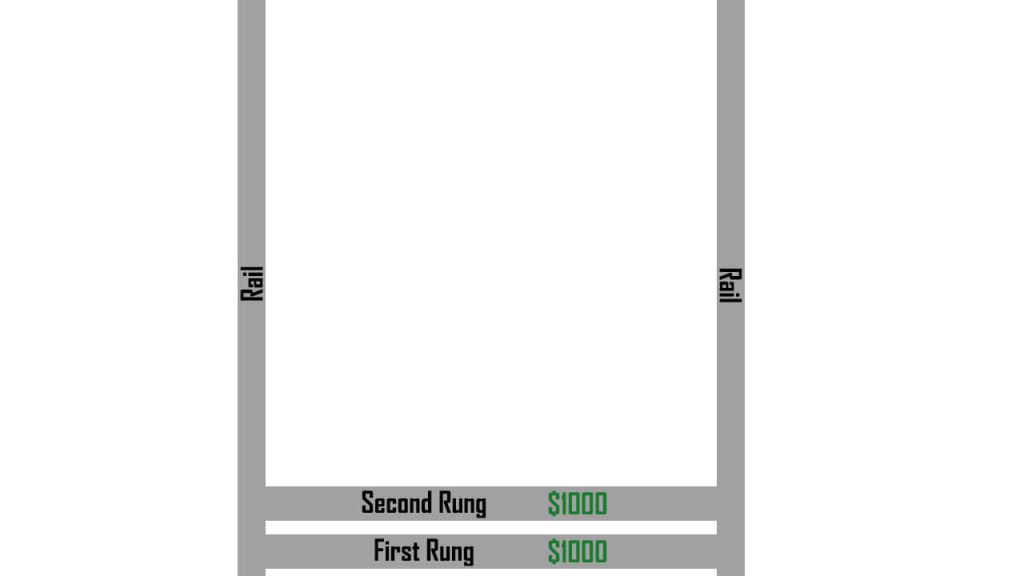

The Second Rung (Vehicles)

Next, you need an investment vehicle to get a return on. First of all, your investment vehicle needs to be secure, preferably backed by your government or at the very least, very highly rated. Second of all, the maturity needs to suit the timeframe you have in mind for your funds.

If you want your emergency savings to last you 6 months, a six-month maturity option is needed. Likewise, if you want 12, then aim for 12. If you need 7, then you can kind of compromise, but you’re smart, you can figure something out.

Next, the vehicle needs to offer a return above inflation, and above savings accounts. If you couldn’t find something secure with more return than a savings account then scrap the idea. But by all means, you should be able to. As long as it isn’t high risk, like p2p lending for example.

The best investment vehicle that comes to mind is a CD(Certificate of Deposit), or a term deposit, depending on what part of the world you’re from. There may be other options open to you, but let’s stick with these for easy examples. Let’s say we’ve found one for 3% to keep maths simple. These CDs will form the rungs of your new emergency ladder fund

Building Your Emergency Ladder

So now you have an investment vehicle, and know what you need per month, and know the maturity, it’s time to start building your emergency ladder fund.

You first start by taking the first division of your emergency fund and putting it into a vehicle. In our example, you take $1000 and put it into a CD with a 12-month maturity at 3% interest. This is the first rung of your ladder.

This doesn’t look like very much of a ladder…yet!

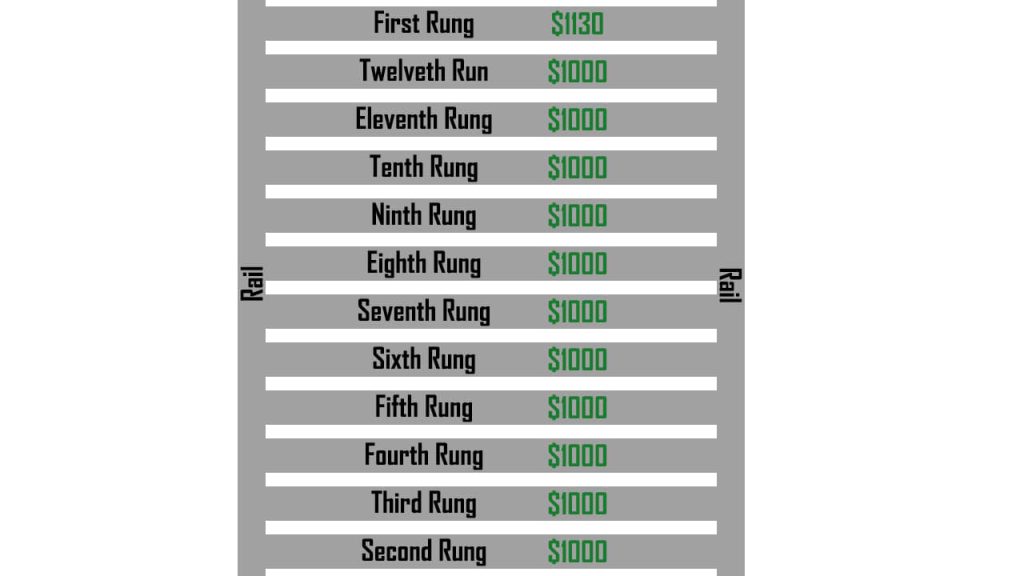

The following month, we do the same and put $1000 into a CD with a 12-month maturity @ 3% interest.

Ok looking better…

We continue to do this with months 3 through to 11. And then again one last time for 12.

That’s what I call a ladder! *I see the typo*

We now have a 12 rung ladder. Then, month 13 rolls around, and we now have our first rung open up again, and pay us out our $1000 plus $30 interest, I’m ignoring tax for the sake of simplicity.

We make any additional contributions we want to, say in this instance we add another $100, and lock it back into the CD with a 12-month maturity at 3%.

Even more stable now!

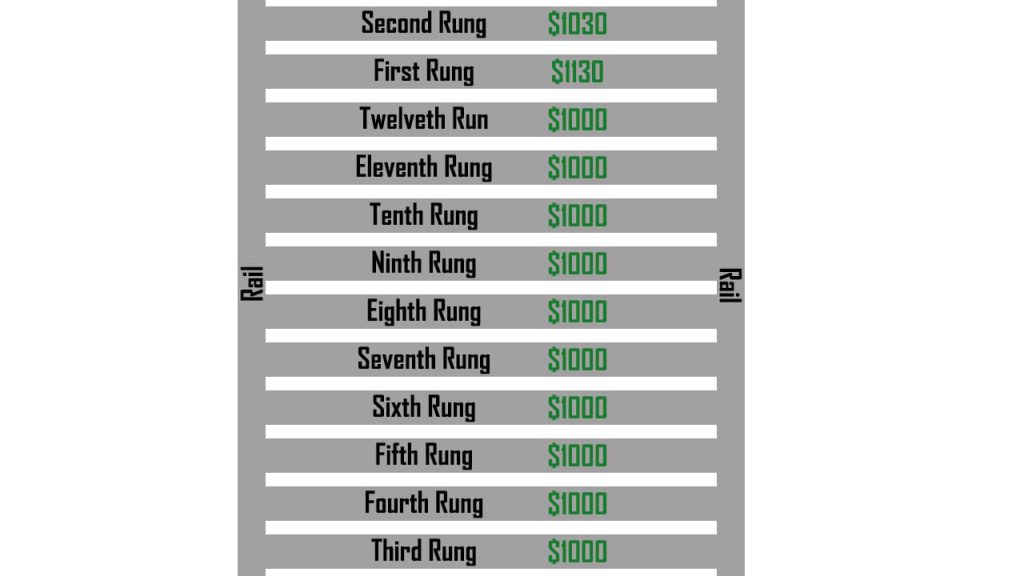

The same happens in month 14, and you receive your funds, and to exacerbate the example, we don’t make additional contributions, then lock it back up for 12 months.

So now your ladder looks like this.

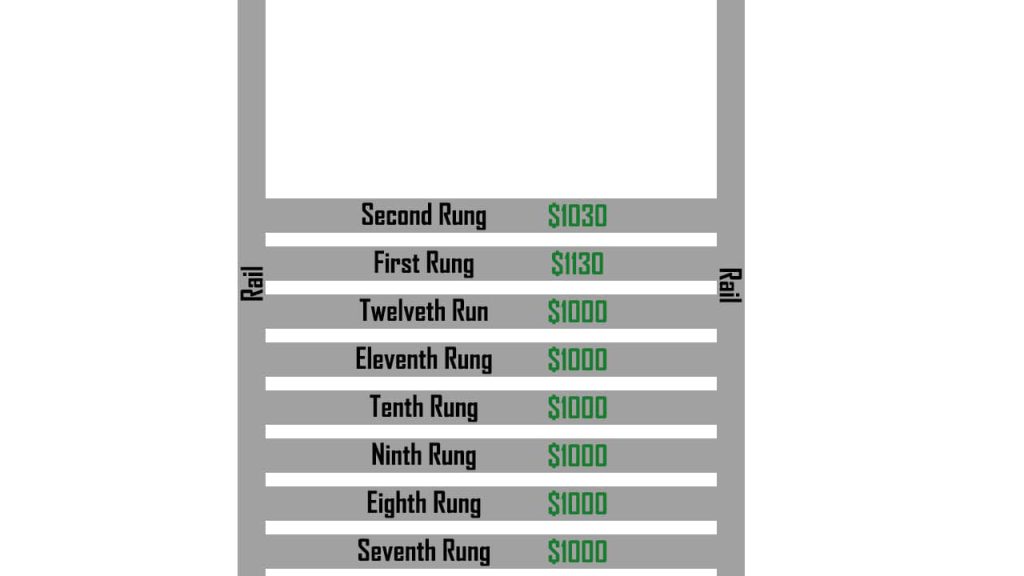

You can keep doing this until one day you need the funds, say you lost a big customer in your business or lost your job. Suddenly this ladder you created is delivering funds to you every month to live off of or use to get back on your feet.

Instead of adding to the fund, you receive it, take what you need and put the balance aside at the end of the month, preferably into a savings account.

One rung down, but 12 to go!

You keep doing this until the ladder lets you climb back to safety.

Not a bad rung, overall. Too much of a climb? Ok I’ll stop.

Once you are back on your feet, it’s time to pick up the pieces and put the ladder back together again.

Balancing it Out

Remember, your emergency ladder fund doesn’t have to be so linear. Maybe you find you need more power in the winter months, maybe you need your car less in summer. You just divide the fund up appropriately and put more in some months than others.

You may also find that you’re happy to drop down to the bones of your butt as well. This is well and true when it’s just you have to account for. You may budget for living in your car or bunking with a friend. If you have a family to keep safe, that’s another story. Always remember to consider your circumstances in your financial goals and put measures in place accordingly.

The Emergency Ladder

So the emergency ladder fund is a structure you use to build a non-sustainable income. In essence, you take your emergency fund and break it apart into smaller amounts for the period you want it to last for and put it into separate investments with maturities to suit your funds’ longevity.

What do you reckon? Would you look at implementing this sort of strategy with your emergency fund or are you more of a traditionalist and will stick with something more like a plain old savings account? Let me know in the comments below.

Thanks for reading until the end. You can scroll down for a little more to read, or check me out on Twitter, or watch my content on YouTube.

Yours,