Disclaimer: I am not a financial advisor and this page exists to aid you in your research, but not make or suggest decisions for you. Further research is recommended for you to draw a conclusion of your own. Additionally some links contained on this page may be affiliate links in which Dynastus will receive a portion of sales at no additional expense to you.

Often times a wealth mindset starts at home. Parents attitudes towards money are often inherited by their children, and in turn, by their children’s children and so on. Unfortunately, it’s way easier to be poor than to be wealthy, hence why there are far more poor people than wealthy. Despite this fact, with discipline and work, its 100% possible to break out of this mindset. Take Li Ka-shing for example, the wealthiest man in Hong Kong.

Li Ka-shing started life as a floor sweeper at a plastics factory, leaving school at the age of 15, following the death of his father. Li Ka-shing worked 22(!) hours a day, living on site. With a wealth mindset, he went onto found a plastics company of his own, then ultimately presided over a business and investment empire worth(as at 2018) over $37.7 Billion. Quite a dude indeed and an inspiration for Founding Parents everywhere.

If you have a desire to build “Old Money” for your family(like we do) then reconstructing your mentality to a wealth mindset is paramount. In fact, before you embark on any radical lifestyle shift, you should start with whats up here(I’m pointing to my head). Of course, reading this post won’t be enough. Studying(especially philosophy), working on your mentality and practicing discipline will be the main factors that build your wealth mindset and thus influence your life.

Stop Expecting and Start Deserving

Let’s start with the most misused word in modern English, ‘deserve’. I detest this word’s use in a lot of the modern populace. How many people have you heard say “I deserve this.”? All the while they’re spending their weekends on Netflix, or out partying, or rushing to get home after work to catch their favorite shows.

Story Time. A guy I used to work with, let’s call him ‘L’, went to our boss demanding a pay rise. He claimed deserved it. It didn’t even seem to occur to him that myself and 2 other workers spent 30 hours of our long weekend fixing L’s muck up, aka lazy mistake. This dude, who I mistakenly appointed as ‘cable co-ordinator’ during a machine installation, created a pile of spaghetti at a crucial junction. this resulted in a bundle of cables going around the corner that resembled something ‘just like mama used to make’ rather than an orderly cable bundle on a showpiece machine. The head boss complained to me, so I, of course, fixed it.

It took convincing a contractor and fellow employee to help me out – it was a lot of tackle alone. We got it done in over the course of 3 days. 30 hours for me, and 15 each for the contractor and employee. This was on top of my two 13 hour night shifts at a cardboard plant. Then ‘L’, that cheeky prink, had the audacity to think he deserved a pay rise!? The smell of the weekend’s booze and cigarettes fresh on his breath! What a knob-jockey – the boss blew up at him of course, ‘L’ had nearly cost our company the contract! When I went for a pay rise a wee bit later, I got it, no questions asked. Same amount of work, another $200 a week in my pocket(big hours though).

Sorry, I digress. Worked out lucrative for me, however, nearly a weeks pay for one weekend, a pay rise, and I got to hang out with good company, eat good food(from the local Don Buri Shop) and that ticked me over the line to buy another rental property. All from stepping up to the challenge and fixing the mistake of somebody else. I was tired at the end of it, but there was no rest, back into the 90-hour-week fray.

Back on track, let’s draw from dictionary.com for a minute. They list the definition of ‘deserve’ as:

Deserve (Verb), “To merit, be qualified for, or have a claim to (reward, assistance, punishment, etc.) because of actions, qualities, or situation“

Would this definition not suggest that you are where you are because you deserve to be? That said, if you want anything, you have to deserve it. Want to be fit? Exercise. Want more money? Work at a second income stream. Want to be screamed at by your boss? Piss off for the long weekend after an embarrassing display of laziness & screwing a job up. You get the point. ‘L’ was a super nice young man, I did really like him as a person. But because you are charitable or good-natured doesn’t imply you deserve anything unrelated to these. Stop expecting and start deserving.

Poorly Spent Money is Wasted Time

Time is Money, we’ve all heard it. There is a tonne of ways to interpret this, but for a wealth mindset, there are two that really matter.

Time is the one currency they’re not making any more of, and each second that ticks by is you spending this currency. Putting credence on time is a large part of the wealth mindset. Convert it into money, pleasure, leisure, misery, knowledge or squander it watching a wall. No matter what you do, you aren’t getting it back, you can’t open a high-interest savings account and spend it later with moderate gains, once it’s gone, it’s gone. You can make each second count, and you can prolong the time you have by taking care of yourself, other than that, once your times up, it’s up. So why not spend it well?

In addition to this rather obvious(if a little disheartening) observation, every moment you spend earning money makes that money equal time too. So every time you spend money you’ve taken the time to earn, you’re spending time and not deploying that time in a useful manner. Ok, so that’s a little confusing so let’s break it down with an example.

Let’s say you really want a doughnut(I want one right now, lol). Suppose the doughnut cost $5, let’s also suppose you make $10/hour. Putting these side by side should be obvious, but that doughnut is costing you half an hour of your time. Now to get yourself back to where you were, you have to work another half hour. So that one bloody doughnut technically cost you an hour of your life. Worth it? Eh, sometimes, but that better be a bloody nice doughnut. Most people spend 1-2 hours of their pay each day on food, just to make their workday tolerable. So really, they’re only making 6 or 7 hours of their workday count, not including earning that money back. Employing a wealth mindset would be to keep as many of those worked hours in your pocket as possible.

So let’s say you worked 250 days of the year, and these 250 days were doughnuts-less, you would have saved up a total of $1,250. Calculation: (52 weeks * 5 days – 10 [I think they’re called]days off) * $5 Doughnuts = $1250. Oh my golden rings, it adds up, right? Now let’s say you put that money into an investment returning 10%. This investment would bang out $125 a year, aka 25 doughnuts year. And while it also takes work to find and maintain an investment returning that, it isn’t going to take you 12.5 hours more annually to make that, thus making your time more lucrative OR freeing up time, so you can do more good with it or eat more doughnuts. Boom baby.

It may not seem like much, but if you do a tally of all the times you do this eg: buy take out when you can cook nutritious meals at home, buying a video game you don’t really need, paying for a service you barely use, paying for cleaning products when baking soda and vinegar clean most things, etc – this stacks up fast. All of these savings can be put towards building your wealth, they will continue to build your wealth indefinitely, rather than other peoples. Given enough, you could purchase or pay off your family sanctuary, or put it toward a method to generate family wealth. It takes discipline to do this, which brings me to my next point.

Catch Yourself Early

You need to stop letting your mind wander and think a few steps ahead to maintain a wealth mindset. Sure, Mc Donalds tastes nice (arguably) but after you’re done, you’re going to feel like crap, and have to work harder to burn the weight and junky feeling off. Good investment? Hardly.

If you’re thinking about a purchase, DON’T make a split second decision to get it. Do you really need another set of caps that have duck on them or to ‘upgrade’ your cutlery(can you really improve a fork, what with another prong?). Instead, think of the time value of that money the consequences and impact on your life and think if it’s really worth it. It took me 3 weeks to decide to buy bathroom scales($10) and we normally wait until we run up a few requirements before making a trip to the bulk grocery store – consequently saving time, gas and making big savings on what we need.

The same goes for the thoughts that cross your mind. If you tell yourself you cant do something, guess what, you probably can’t, not with numero uno (you) putting you down. Worse still, once you succumb to negative thoughts, you begin a negative spiral, which is hard to get out of it. If you can catch yourself early, you can stop the rapid descent into self-pity and loathing. Other people can trigger this too, and you need to know when to nip it in the bud and agree to disagree and move on.

While we’re on this subject, don’t disown a friend with a different mindset. I really dislike the ‘only befriend successful people’ mantra. Instead it’s better you just agree on your differences and carry on as friends. If your relationship is based on you both being unhappy and filled with disbelief, then were you really friends to begin with?

I understand this isn’t easy for everybody, I can’t really offer you personal advice if you have a mental health condition honestly(I don’t think many people really can). I have bipolar disorder, so I know it can be really tough some days(or weeks) to break out of the cycle. You do need to take time to recover from emotionally draining circumstances and find what works for you.

I know when I get really down I typically take time off or try to do something more physically engaging, but still productive. This is typically gardening, building something in the yard, or fixing something around the house. It’s hard to write, run a business, analyze investments, study, face people etc when you’re like this. Taking time off is OK, it helps you reflect and grow, but try to be productive in this time off. Being productive helps the recovery process and gives you something to focus on rather than dwell on the negative.

Good Value over Cheap

Things have different value to different people. I imagine a bottle of water would be far more valuable to a somebody in the desert than to somebody in suburbia(without a zombie apocalypse), and a sand pit may be a little more valuable to the suburban home than to this poor soul lost in the desert. This is an example of the contrast of value, albeit an extreme one.

So how does this apply to you? You are obviously going to put credence on what is most needed in your life. Let’s use a vehicle as an example. With a wealth mindset, if you need a car for general use, you should be looking for one that has the most value to you in your situation, this is the application of a wealth mindset. If you’re like me(and if you’ve read this far, I imagine you are) the factors important to you and your purchasing decision are most likely going to be fuel efficiency, difficulty/cost of repairs, cost of tires, storage space etc. I picked my Honda Accord station wagon as it’s safe, has a huge boot with fold down seats(great for contracting), can use as a family vehicle, has great fuel efficiency(I’m getting 700-800k per 55L tank).

Contrastingly if you’re a high rolling oil tycoon, I imagine fuel efficiency and affordability of parts aren’t going to be your chief concerns. If you rolled up in a honda accord you might have some difficulty closing deals or convincing people of your wealth in a world where impressions really count and may find more value in an Aston Martin, Rolls Royce or similar. Getting a better return on your vehicle(financially or otherwise) is an example of a wealth mindset.

If you were in a lesser position and bought or were given a high-roller car, the car may be expensive but not valuable. Having a high-roller car is a constant ongoing cost that most people cant afford, and buying one when you aren’t in a true financial position to own one is actually detrimental, and therefore not valuable at all. You’d be better off selling the expensive car, and buying a ‘personally valuable’ one, and investing the difference to cover the running costs of your ‘valuable’ vehicle. Also, I’m not a car guy…can you tell?

Another less ‘mobile’ example is, when we first moved into our home, we got a set of pans for $25. These 3 pans sucked(well, mainly the large one), and we had them for 2 years. 2 years of uneven cooking, pancakes that were thin of the inside and thick of the outside. These were cheap, and I was not being frugal. You see, the large pan was warped by the heat of the stove. Repeatedly heating and cooling with a concentration on the center caused the metal of the pan to contract and warp. This made it lift up, creating an ever-so-slight hill in the pan. This coupled with poor thermal capacitance and high conductivity created a hot spot int he middle, and a not-so-hot outer ring.

We ultimately bought 2 new pan, which cost about double the set(when we bought it) for ONE. One pan is made of a thicker cast iron(as opposed to a cheap-steel compound) and is heavier duty in general, the other is made from carbon-steel. I imagine these will last at least 25 good years, as opposed to 2 crappy ones. So we’re getting a longer working life out of the valuable pans which works out to around $4/year as opposed to the cheaper pans for $25 for 2 years($12.50/year). And the Sunday pancakes are way nicer too!

Money Makes Money (The Snowball Effect)

A lot of people go on about investing money and living off the income in short order. BS. It’s all well and true if you have the money to begin with. Pretending taxes aren’t a thing, if you invest $1,000,000 at 10%, you’re getting $100,000 a year, which you could comfortably live on, with some to spare to reinvest. But if you have $10,000 and invest at 10% you’re only getting $1,000 a year, considerably harder to survive on that. With that in mind, you’d need to keep the$ 1000 to accumulate $11,000 total, and so on.

So you need money to make money, and to accumulate it, you need to cut expenses and increase income. By building a budget, working hard at your revenue sources(jobs, businesses or side hustles) you’ll be able to save and build wealth for yourself and your family. Remember, in a wealth mindset, every dollar saved is not only a dollar earned but also a dollar that can go to work to earn even more for you. These dollars can be employed in stocks, bonds, any number of other investments or assets or even in a business/side hustle(like raising worms). With enough of these little workers, you can create what’s known as the snowball effect.

The snowball effect is best understood when compared with its namesake. If you start with little bits of snow, clumping them together, all you get is a wad of snow that will sit there, but if you keep clumping these bits of snow together and work them into a ball, this ball can roll downhill, accumulating snow and growing larger along the way. To put this in real terms, by saving bits of money here and there, creating new sources of revenue and putting them to work on your’ snowball’ eventually your wealth will be able to provide for all of your expenses and grow by its own accord.

If you manage to build up a portfolio that provided $50,000 a year for you, but you needed to live on every dollar, then this still isn’t a snowball. But if you built your wealth into a portfolio that provided $100,000 for you and only spent $50,000, then you have indeed created a snowball. This snowball can feasibly provide for you and grow on its own indefinitely(with a little guidance from you of course).

The Snowball is a biography about Warren Buffet from youth to the relative present. Buffet is a great example of the snowball effect. I never actually finished the book honestly(I got sidetracked with other books), but the first half of The Snowball was really good. You can find it on Amazon, by clicking here. Sorry, it’s a link to a search, they wouldn’t let me directly link to the product(conspiracy??).

Be Rich, Don’t Look Rich

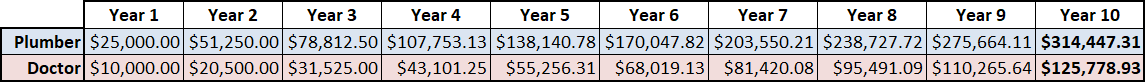

Extravagance is not the right fit for most people. There’s a huge difference between being rich and looking rich. A plumber might make $50,000 and a doctor $100,000. If the plumber toughs it out with a wealth mindset and manages to only spend 25k, they will save 25k a year which they can invest in a simple portfolio returning 5%. The doctor, wanting to look the part, spends $90k leaving him with $10k which he also invests at 5%. Over the course of 10 years, let’s look at how this picture is painted for each of these people

Increasing income does give you a higher capacity to save, but it’s your actual savings and investments that count. Arguably, the doctor also has less time to manage an investment portfolio or create other income sources than a plumber(if the plumber is an employee). Doctors are also usually on salary and have to live closer to their place of employment, meaning higher rents/property prices. It’s also harder to start out on your own as a doctor. So the plumber is actually at a considerable advantage in growing wealth and their own business to build even more wealth. You may find a doctor will leverage their income to get more credit too, which descends them deep into debt. I’ve heard of it happening but have difficulty believing people truly get themselves into these positions.

One great book you should check out is The Millionaire Next Door. If a little dated, it’s a good read which will help you to save more, build your wealth mindset and keep your spending in line.

Take Action and Adopt a Wealth Mindset

By shifting to a wealth mindset, accumulation of wealth becomes possible. Above all of these points is actually taking action. If you sit on the fence, you’ll eventually fall off. Reading is one thing, but actually taking the advice and putting it into action is what will invoke change. You can’t accumulate wealth until you start trying to and following some(ideally all) of the points listed in this post will shift you towards this goal.

You can’t expect to deserve anything. By the very definition of the word ‘deserve’, if you actually deserve something, it will come. By producing value for others, and seizing opportunities, you will in time amass wealth. Nobody with a wealth mindset cares how hard you work, it’s how much value you produce with that work.

If you work really hard to polish a turd nobody wanted, nobody is going to pay you, even it took you 3 years of toil. Really you could only expect stinky hands, and a very shiny turd. If you provide value in the form of solving somebody, or many people’s, problems they will be more than happy to reward you for it.

Don’t waste your money on pointless crap. Fancy food, toys, knick-knacks, and trinkets are only distractions from your ultimate goal, financial independence. This doesn’t mean you should be deprived of any form of leisure, but each dollar you spend should be carefully evaluated. Accumulating wealth will increase the value of your time, or free up time to put towards other things in your life.

Be value based, not cheap. This is one of the ‘secrets’ to a wealth mindset. By using your money to buy things that actually have value, you will find that over time you will spend far less than if you were to simply be cheap. Expensive things aren’t inherently valuable and will often be a liability in terms of upkeep, especially for those who can’t really afford them.

Money makes money, so by saving what you can, you can leverage it to gain even more. Nobody got wealthy by spending everything they had.

Don’t try to look rich, not only will you make yourself a target, you’ll also miss out on the opportunity to invest what dollars you can save. Focus on what you can save before you look at what you can make. Saving money will allow you to invest in and create new revenue streams.

Learn from everything you do, for better or worse, and use it as an opportunity to grow. Even starting small will open up a realm of possibility and opportunity. This is the wealth mindset. Do you do any of these now? Is there something I should add, or are you looking for more specific advice? Be sure to let me know in the comments below. For more reading, and if you’re wondering where to start, simply start with what you have.

Thanks for reading. Yours,