2020 Update: I have since written a new article with more research and thought on a similar concept. This is called The Family Sanctuary. I highly suggest you read that article as a primary resource. The below article is still relevant, but more supplemental to the new one. Thanks.

Disclaimer: I am not a financial advisor and this page exists to aid you in your research, but not make or suggest decisions for you. Further research is recommended for you to draw a conclusion of your own. Additionally some links contained on this page may be affiliate links in which Dynastus will receive a portion of sales at no additional expense to you.

Land. They aren’t making any more of it…except maybe in Dubai. As population density grows around certain centers, so too does the scarcity and therefore the value of the land in and surrounding it. If your goal, like ours, is to build lasting generational wealth and a family culture that adheres to that principle, then dynastic land should be part of your portfolio.

There are a few ways to look at land. You can either purely speculate, flip land, work the land, or use it as your families base. For the purpose of this article, I’ll mostly be talking about using it as a location to base your family out of, now and in future generations.

Dynastic land is the best solution for multigenerational living situations and provides a solution to space and independence to keep a family ‘together but apart’. A place of permanence for your family is key to building a culture of cooperation rather than conflict. Dynastic land will help avoid cataclysmic conflicts, not to mention having potentially hundreds of people (from a growing family) living in a 3 bedroom suburban home.

What if you don’t want a farm?

This land doesn’t have to be farmland, it can be urban or suburban lots. Urban lots can be built up, with a diverse range of income streams, the same can be said for suburban, but usually on a smaller scale. But the potential liberties and developments you can do on rural land, especially over the course of generations, can be a bit hard to ignore. The Bonner family, two siblings of which wrote Family Fortunes(Review Here | Buy the Book Here) have chateaus, mansions and a couple of farms. Most of which produce income, though their main asset is their business.

This isn’t to say you can buy any old plot in any old place and hold onto it, hoping it appreciates. Even the most suitable land driven by purposefully selected factors can wind up being a burden for years(or generations) if you aren’t careful. It takes meticulous preparation and planning, plus ensuring your children(if you have them now) are ready for this dramatic lifestyle shift.

So let’s deep dive on dynastic land and season it with a pinch of opinion.

A well-maintained orchard situated on family land…probably.

Are you Ready For Dynastic Land?

Before you can even consider purchasing land for your family. There is a tonne of factors to consider. Have you fully developed emotionally to make a sensible decision? How will this choice impact your social life? Do you know what you’re looking for? How about your Family? Can you handle the financial commitment?

There’s are more factor than the four below to consider of course. But these are the biggest factors I have found. Know that the moves you make now could impact your descendants for hundreds of years to come.

Emotionally?

When I was in my very early 20’s I had this grand design in my head that I going to be the long-haired, scraggly bearded, live off the ‘fat of the land’ type. I didn’t care what my girlfriend at the time thought, I didn’t even ask. I was basically a child on this matter. How times change. This mentality lasted until I was around 23, and I am really glad I grew out of it.

I was looking in remote locations, with poor conditions in places I didn’t even know. This was all because I loved the idea of building from the ground up. In reality, while a good saver and hard working, I lacked the skill set to even identify what the land could realistically be used for. Not to mention I spent a lot of my ‘relaxation time’ playing video games, not cutting wood or milking cows.

Point is, you need to make sure you’ve fully emotionally developed prior to beginning your hunt for your family land. For some of us, this can come quite young, and others take a lot longer. Rememebr the male brain isn’t fully developed until age 25, and the female brain is around 22. Be realistic, and ask yourself if this is where you think you will want to be in 20, 40, 60, 80 and 100 years(think about what this implies). You’ll probably start looking for something like this in your 40s or 50s, maybe as your children approach adulthood and are thinking about getting places of their own.

Socially?

You and your family to be emotionally prepared for what this life entails too. You may not move onto the land right away, but if and when you do, will your family appreciate the location and lifestyle the same as you? As always, communication is key.

Remember that social isolation comes with rural properties, and huge management responsibilities come with something like an apartment building or suburban development. If you’re building a luxury estate, maintenance and a staff for that will be a requirement. So no matter what, there’s a big social factor in having dynastic land.

Intellectually?

Before jumping onto any old purchase, make sure you’ve fully researched the type of land you’re looking to buy.

If you’re purchasing an urban lot, having a good grasp of city planning, zoning, the areas and other such factors will be instrumental in making your purchase worthwhile.

Suburban property has similar educational requirements. You’re typically looking at less dense arrangements in the suburbs. Neighbors will play a large influence in how you and your family are treated in this environment. There are also neighborhood specific bylaws to observe.

Rural property may be the most challenging to purchase. It’s an entire business, traditionally passed from one father to the next, or learned from employment in the field of farming(pun intended). It requires specialist knowledge to get things right. Of course, you can learn this or outsource learning it by hiring specialists to make reports for you.

Family-wise?

Children that grow up in these types of environments have totally different childhoods to others. Kids on farms are different from suburban kids, who are different again to kids who grew up in the inner city. Prior to making the leap, consider how this will impact your children. This is a dramatic shift that will most likely tear them from their friends and any sense of familiarity they have if they are a bit older.

Your young kids may get excited by the idea of living in a new environment. It’s important you make sure you haven’t accidentally swayed their opinion that way. “Do you want to live in this dumb old place with all the school bullies? Or do you want to live in this supercool six-plex with no yard and 5 groups of strangers!?”. It’s easy to accidentally do something to this effect in your own excitement.

If you have teenagers, you’re not only ‘ruining their lives'(any parent of teenagers has probably heard that) but you’re also making a shift that may skew their trust of you and your decision making ability. Remember that they are the inheritors of the dynasty, so it’s important to include all your children, young and old in the decision.

Financially?

Any real estate you purchase for yourself, with some rare exceptions, is going to be a financial drain. Not only are you probably going to have a mortgage(though hopefully you’re setting yourself up now to be mortgage free), there are property taxes and upkeep costs as well. If you’re looking at rural land, there will also be added travel costs if you have a job or business in the local center as the time added to your journey.

There are ways to ease the financial burden, you could always flip or divide the land into smaller parcels and sell it. Or build/create revenue streams on the land itself. This can be done whether you’re living on it or not. It may be hard to see a big return, depending on your local market. If you’re planning on operating the land itself, you’ll need to make sure you have the right skill set to do so.

Today I am still not prepared to carry the financial burden of owning a large plot of land. It is a huge undertaking, especially around my countries largest city. I do still have this on the future bucket list as a part of setting up my families estate. (update: I have since bought 10 acres in 2020)

Purpose

Capital Gains vs Income

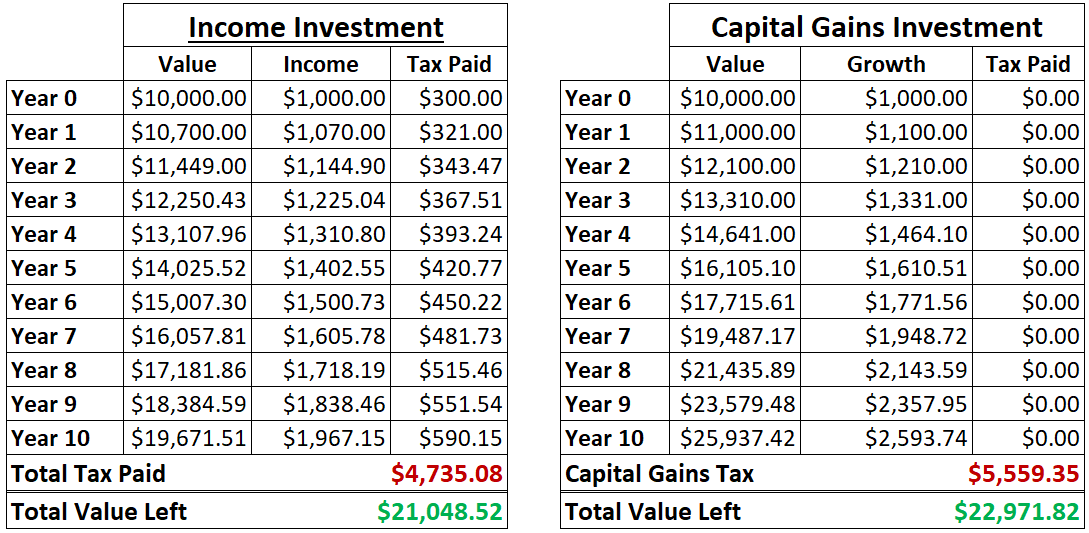

Having assets that appreciate in capital value leads to a huge amount of gains in wealth from tax deferral. Income producing assets need tax paid as they throw off income, whereas assets that grow in capital value gain greater appreciation through tax savings. Even if you pay tax at the end of this period of investment(aka capital gains tax), when you actually sell, you have still benefit from the compounding effect on the tax over time.

Let’s do the math real quick. Let’s take 2 instances and keep it simple.

Income Payments:

In the left chart, we’re, starting with a $10,000 investment. We’ll calculate receiving 10% income with 0% capital gains, and the tax paid is 30%. You’re reinvesting all the income you receive. We’ll then look at how much you have at the end of a 10 Year period, when sold. Assuming no gains, you won’t have to worry about those pesky capital gains taxes.

Capital Gains:

In the right hand chart, we’ll look at capital growth. Still with the same 10% per annum return, but this time it’s all remains in the investment capital growth. the same 30% capital gains tax is paid when it’s time to sell.

As you can see, the capital gains ultimately is worth a lot more at the end of the 10 year period. You can’t eat capital gains, however. Unless you sell I suppose, but then you have no land. So having income is obviously a necessity. Dynastic Land can be set up in such a way that it provides both income and capital gains. Finding the correct balance to suit you is key.

You can learn more about all this in my post on Growth vs Income.

Choosing the Ultimate Objective

What you have in mind for your families future and what your human capital is centered around is going to ultimately influence what kind of land you purchase. If you’re chasing the traditional farming lifestyle, then a rural property with arable land or pastures is going to be more your speed. If you’re looking to dominate in the urban space, then buying something akin to an apartment complex might be more your taste. Suburban developments are again a different beast altogether. Land will be more limited in the suburbs, you may be better off buying adjacent houses or duplexes etc.

Jumping back to rural land, you can typically get much larger parcels and have more liberties, not to mention have the potential to develop more primary industries. The added effect of a growing urban sprawl can later put your family land on a burgeoning gentrified development.

Location

Choosing the location of your land requires a lot of research, more than I can encompass here. If you’re looking at urban land, you’ll need an extensive understanding of what you’re targeting, whether you’re purchasing raw land or an apartment complex.

Suburban land is different again, the building restrictions and height limitations will greatly restrict you in what you can build. If you’re purchasing a larger plot, then the limits on number of dwelling you can build or if you can develop your own road(is this possible?) will affect future values.

Rural Land is complicated in its own right. The simple life is easy to romanticize, but checking for the mineral content of the soil, climate, neighbors, the types of grasses in the pasture, fence condition, covenants, building limitations, existing diseases…yeah. There’s plenty to consider. But set up properly, this traditional dynastic land model can serve as a great base for permanence in your family.

This multi-purpose commercial building could serve as dynastic land.

Timing

Purchasing Land Early in building your Dynasty gives it more time to appreciate in value. But you don’t want to cripple your finances and enslave yourself to a life of debt.

Similarly, if you wait too long, you may lose the opportunity to capitalize on building a family culture based on the land, its history and traditions and memories which happen on it. Not to mention miss many years of appreciation on its capital value.

If anything it’s better to be too late than too early. If you’re the type that gets super motivated with a fire beneath your feet though, then maybe it’s better if that fire is the financing for this land. It’s 100% reliant on your personal temperament. Not financial advice at all.

Lastly, timing your purchase in the right spot in the property cycle will save you a lot of heartaches. Purchasing at the beginning of an upswing is the best time if you can identify it. Making capital gains using the property cycle can give you the extra financing you can then use to develop the land. You can use this to potentially produce income and increase its value further.

Developing Your land

Your land should have a specific purpose, and this in large part is going to play a role in how you select it and how you develop it.

Location and development both play a huge role. If you’re purchasing apartments, then tidying each of them up and selecting the correct tenants will add value. Likewise, if you plant an orchard on farmland that takes 100 years to mature, like an olive grove, you’re adding a huge amount of value.

You may be building a business centralized around your land. This can be something traditional like a farm or apartment building, or less traditional like a commercial building that houses storage units.

If you’re primarily building a luxury estate, then the amount of income you’ll need to have to sustain it from outside sources will be significantly higher than if you’re aiming for something more humble or modest. The Rockefeller’s holiday home, held for multiple generations now, is an extreme example of such an asset.

No matter what kind of family land you’re aiming for, you want to perpetually be growing its value and not just sitting on your hands.

Homes

Building or renovating homes for your family on your land is going to give each of your children a huge head-start in life. You don’t have to do this too early. In fact, it may be better that your children pay to build their own houses on the family land. It can be their way of contributing and moving out of home, while simultaneously adding value to a family asset. This could be classed as a means of creating family financial capital using The Collective Method.

If kids stay living with their parents for the beginning stage of adulthood, they’ll be able to save a substantial amount. This mount can be put into the family land to first build their own homes, and perhaps later build additional homes as rental properties or other developments to produce additional income for the family.

These homes could do with a touch-up.

The Interim Period

While you are growing your wealth and your family, you may find little use for the land in the interim. If you’re still at the point where most of your family income is coming from a job/s and are unable to find work in close proximity to your land, you’ll have to find another use for it in the interim. Ideally you wan tot still be profiting from it if it’s at all possible. At the very least you want to be minimizing your losses.

You can come up with any purpose imaginable. You can lease it out as working land to neighbors and collect a small sum, or you can try setting up productive structures to lease. If you have the entrepreneurial mindset, you can set it up as a functional farm and use this as a basis for your family enterprise. Obviously, without having a background in farming, you’re going to find this nearly impossible and will need to hire in outside help.

You could just use it for family holidays and as a place for family projects to take place until you’ve established enough of the land/building to justify moving onto it. It’s your call, but remember it will be a financial burden as long as it isn’t productive.

Producing an Income

If you can produce something from your land, then you’ll not only be able to have a home but an income stream or business as well. If you’re aiming for something more passive, having a commercial property or residential buildings will typically beat something like farmland or a business. The latter two can still have passive aspects to them with a bit of further development, though upfront work and creativity will be a necessity.

Below are some ideas for adding value or income to your property:

- Timber Forests

- Orchards

- Farming

- Subleasing

- Greenhouses

- Residential Dwellings

- Beehives

- Air Bnb or Traditional Bed & Breakfast

- Self-Storage Sheds

- Packing Houses

- Pick-Your-Own Fruit Establishments

- Cafe/shop row

- Event Venue

This greenhouse/polytunnel is a good example of an income-producing asset on some land.

Is Dynastic Land for You?

Not everybody is going to find the concept of Dynastic Land appealing. But it doesn’t have to be reserved for the rich. With proper planning, it can play a huge role in creating and preserving generational wealth. It will be a time and cash sink for a good long while, but the payoff can be immense. Going into a project like this blind will be a surefire way to lose a large amount of money. To ensure your children don’t just sell whatever you attempt to set up, you need to make sure it suits them, their future and their lifestyle as well. It’s not just you to consider, but your family and their future as well. Multi-generational Living doesn’t have to be the end-goal either, it can simply be a long-term asset for a family. Olive groves can take 100 years before a decent yield is achieved – that’s some long-term thinking.

All things going well, Dynastic Land can serve as a center piece, grounded in tradition and steeped in family history. You can develop your land, be it urban, suburban or rural in any number of ways. Adding value and income is paramount to securing your families future on this property. That is, unless you have sufficient income coming from other places or investments.

So what do you reckon? Is setting something up like this your cup of tea? Will you target rural, suburban or urban property? I’d love to discuss it with you. Drop me a comment in the section below.

I do suggest you go and read my updated version of this article, “The Family Sanctuary“, for expanded knowledge and concepts.